Before Launch Series: Part 3

Operations: Ironing out the kinks in a low-risk environment

In part 1 of the Before Launch Series, I shared some of the administrative tasks associated with starting up your search fund, from selecting your tech stack to networking with 3rd party providers and others in the search community. In part 2, we discussed the basics of search fund branding, from creating your brand identity to developing a website and marketing materials with consistent messaging. Today, I will walk through actionable steps to build out your operations for the search process in a low-risk environment, regardless of your strategy or fund structure. Those steps include the following:

Industry first, company second

Developing repeatable sourcing processes

Data infrastructure

Testing email campaigns

Qualifying owners

If you have not already, I encourage you to check out the previous posts in the Before Launch Series to get fully up to speed. More information can be found below:

Overview – Four-part newsletter series to help you prepare for the first day of your search

Part 2 – Branding: Making your search fund brand come to life

Prior to your first owner call, site visit, LOI, and acquisition, you need to develop a system that will help you achieve each of those milestones. Putting some structure into place that’s personalized to your own working style will not only give you a jump start on your search once you call capital, but also provide you with a foundation to fall back on when trying to recover from a broken deal or a drop in spirits or motivation later on in the process. The core operations of your search engine will change quite a bit as you get into a rhythm later on, and that’s okay. Many will occur as you learn on the spot but without processes in place, you’ll spend less time with owners and more on organizing your multiple workflows.

Industry first, company second

It is best practice for most searchers to conduct an industry thesis-led search. Let’s unpack this idea a bit. Simply put, searchers are encouraged to focus on a set of industries (and sometimes certain business models) at a given point in time. The initial industries a searcher may have will usually come from their PPM and were a function of their prior experiences and investor preferences. Searchers (both traditional and self-funded) spend a significant amount of their time getting “smart” in niche spaces to become more competitive buyers. Understanding the inner workings of a particular industry will help searchers better connect with owners and be able to more quickly evaluate prospective deals and the risks associated with them. In a highly competitive environment where business owners are contacted frequently by other financial buyers and strategics, industry and functional knowledge can prove to be a real differentiator for searchers.

We’ve established why it is important to start with industries but how do you go from these broad ideas and knowledge to finding compatible companies to contact? Without an industry-first approach, we run the risk of fishing in the wrong pond entirely (i.e., looking at companies outside of our investment criteria) or fishing in both the right ponds and wrong ones (i.e., companies both inside and outside of our investment criteria), which waste precious time and resources. This applies to geographically-focused searches as well – you need to ensure that you are putting guard rails on where you will be fishing. Enough fish talk.

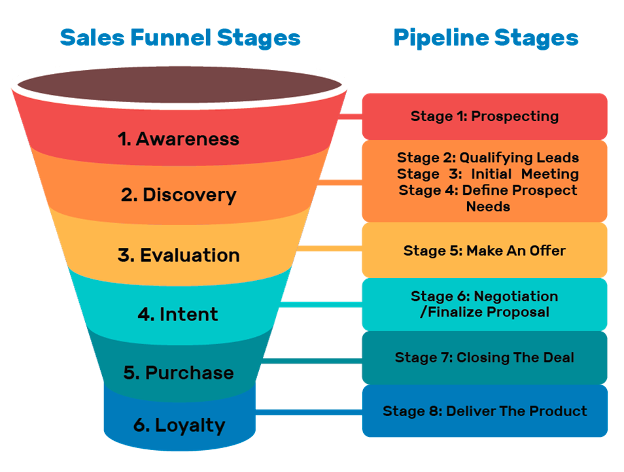

The search phase boils down to building a sourcing funnel, similar to what sales, recruiting, and marketing teams have done for decades to find their target prospects. Historically this approach is thought of in the context of selling something (i.e., a service or product), but a sourcing funnel directly applies here as well. Searchers are selling a service (i.e., succession plan and liquidity) to a business owner who may be interested in making an exit.

While we are technically buyers and not sellers, selling yourself is crucial here and utilizing this powerful framework helps you structure your focus regarding your areas of interest. So what are the various stages of the sourcing (sales) funnel?

Awareness – sourcing opportunities

Discovery – qualifying leads and meeting with business owners

Evaluation – reviewing preliminary data on business and developing relationships with owners

Intent – submit and execute a letter of intent (LOI)

Due Diligence

Close and Operate

There are other ways to break down the funnel, but regardless of how you do it, the main goal is to have enough quality opportunities enter the top of your funnel and the necessary processes in place to filter one down into to an acquisition. The importance of building a sales funnel for your search cannot be overstated, especially if you do not come from a sales background. If already know this, I am sorry for wasting 30 seconds of your time.

With that context out of the way (and my poor sense of dry humor), let’s dive into some processes you can consider to help you find the right ponds and start fishing. For this section, we will focus on the cadence from developing new industry ideas to getting the raw data captured to reach out to business owners.

Developing repeatable sourcing processes

If you’ve been around the ETA community enough, you’ll frequently hear from searchers and investors that it is unlikely you will acquire a business in the first two to three industries that you choose to focus in one. While it’s not impossible, it helps to build a system that factors in idea generation with proper gating in the event you hit a brick wall with an industry. Prior to launching, I built an eight-step process that helps me structure my industry and business related activities, and it is a process that I utilize in my search today. Other posts will go into specifics on how I do certain activities within these steps, but searchers should be thinking about a similar process for themselves whether it’s this one or something entirely different.

The first four steps of my process are focused on industry-related activities while the next four are company-focused ones deriving from that specific industry. I spend much more time in certain steps than others, and it will depend largely on where I am at with the search and how much runway I have left with niches I am looking at. It’s a fluid process – at the beginning our team may focus on one step at a time, while later on we might be actively reaching out to owners while continuing our research or finding new companies. However, this eight-step process helps me stay on track while being able to communicate with interns about our direction. Let’s quickly review the objectives of each of the steps, more of which can be seen in the graphic below.

Industry

Ideation: The first step is all about leveraging our existing knowledge and capabilities to come up with potential industries where I’d strive to become an expert in over time. The ideation stage includes both unstructured and structured brainstorming and occurs when I do not have niches in our backlog that I’d like to research more.

Screening: This step is a gating mechanism that aims to catch unattractive industries going into our sales funnel to save our team time. In the past we rushed through this process and spent multiple weeks reaching out to business owners in an area where we had no business searching. We use an objective scorecard that an industry must pass in order to move onto deeper research.

Research: Once we’ve screened an industry and I provide approval to our team, we do a deep-dive analysis and note our changes in thinking from the scorecard. Elements of this step include market sizing, competitive landscape, core products/services offered by companies, searcher fit, M&A activity, risks, etc.

Logging: One final step within industry-focused analysis is for us to quickly log in a separate spreadsheet for future reference, whether it be recalling previous analysis and geting interns up to speed during the onboarding process.

Company

Sourcing: Now we move into sourcing, the first step within the company-focused activities. This stage primarily involves list building from private company databases (i.e., Grata, ZoomInfo, LinkedIn) using filtering to target appropriate prospects.

Cleaning: The cleaning stage involves not only reorganizing company data but also drafting additional information that is tailored to certain inputs of our email campaign. This step, along with 2, 3, and 5, is where interns spend their time.

Campaigns: Once we’ve gotten to a stage where our data is cleaned and complete, I manage the process of designing email campaigns and uploading data into the sequences to ensure quality control.

Relationships: I could also call this stage ‘Qualifying’. As I send out emails and follow-up with owners, my focus shifts to building rapport with them and gaining alignment with them on a potential fit (also known as qualifying). More to come on this shortly.

Data infrastructure

I will be writing a detailed post in the coming months on the topic of data for searchers, but as you get setup before launching, you need to reflect on what data you actually want to capture. The main table that you need to consider before the launch is for your email outreach campaigns. Data tools like Grata have numerous fields that you can export into a CSV file, but you only need certain aspects of it to send quality, personalized emails.

Some questions you should consider:

How do I want to store information on companies I plan to reach out to or have already contacted?

What data fields are most critical in achieving your goals (i.e., contacting owners with a positive reply) and how do you get that data?

Are there data fields that you’d like to have about companies that do not exist? How do you plan to create that data?

How do you ensure the highest data quality possible to prevent invalid emails, typos, and other formatting errors?

How often should I update my tables? Is there a master table that is a source of truth and do you have that data backed up?

How do I want to measure performance of my email campaigns and intern sourcing activities?

How do I manage relationships with owners and track developments in conversations?

We all have our own working styles when it comes to managing large amounts of data, so before diving into the exercise, reflect on what it is that you’re looking to achieve. Though not exhaustive, I offer a few bits of advice at this stage.

Keep it simple. Only capture or create data that you use for direct sourcing activities or planning.

Have a single source of truth that stores target company data and any relevant performance measures within it.

Whenever team members are list building, cleaning, or creating data, have them work on a separate file from your single source of truth. Google Sheets shared files can work well here.

Keep data on a particular company limited to one row and use columns for data fields describing that company. If you are a bit more advanced and prefer to do so, you can structure your data more vertically. However, over time it may be hard to manage with the various fields you track. PRO TIP: keep a unique identifier for each opportunity to easily join data sets and prevent duplication.

Avoid including companies into your CRM until you’ve had a conversation with the owner. This is a personal preference but it can make data management much easier.

Testing email campaigns

I discussed email sequence tools available to searchers in Part 1, so I will not go into detail on options today but instead discuss more substance on setting up your email campaigns. Depending on your strategy, you may want to consider crafting your email campaigns prior to thinking about your data structure in order to influence what fields you need. More importantly at this point, you need to get comfortable with how these tools work and how to make the most of them, not necessarily executing campaigns just yet. To the extent there’s interest, I am more than happy to walk through some tips in a more detailed post, but for today, I want to highlight a few elements that you need to think through.

Personalization vs. generic

Where do you fall on the spectrum of personalization vs. generic for sending out emails to owners? Personalization will obviously improve read and response rates, but how scalable are they? Generic approaches help you cast a wide net, but how effective will that be when you’re aiming to catch a reader’s attention in a few seconds and make a good impression? Everyone has their own opinions on how to find that perfect balance between scale and personalization, and I like to view my approach as ‘systematic personalization’.

There are two components that go into this approach, one being the narrative of the email (i.e., hook, value proposition, story, etc.) and the other being data fields that are included in it (i.e., name, company, etc.). I think of the narrative of an outreach email as the foundation of every message that I’d like to send out. However, that message might change depending on whether I am talking to the owner of a commercial landscaping company or one of a fintech startup. What I aim to do is take aspects of my experience, personality, and the target audience to create a story that is tailored to them. This only works if you have good data and specific industries you are looking at – a generic outreach program like this will not work. That being said, you can easily use a location-based narrative as the structure for your outreach and then personalize further with the second component of systematic personalization, data fields.

Data fields in this context are the variables that you will use to personalize your email to a particular business owner. Some of those may be their personal email address (so you can actually send the email), first name, company name, industry, business model, location, or a short description of why you are interested in them. The more specific you can be in addressing an individual in a personal way, the better your response rates will be on average.

In order to implement such a process, you must consider what aspects of your professional and personal life may help you relate to an owner more effectively in a particular industry. But one email to an owner will not suffice. Like any good sales campaign, follow ups play a crucial role to success in getting in contact with an owner.

Frequency

For rookies in outbound sales tactcs (don’t worry, I was once here), it may be a bit frightening to think about sending messages to someone more than once. If an owner doesn’t respond to my initial email, they must not be interested, right? Maybe, but in most cases, I’d say likely not.

Business owners, like us, are very busy and receive many emails a week from salespeople trying to get their attention. Maybe they see your email and get pulled in another direction or it gets lost in a sea of other messages. Whatever the case may be, your outreach strategy must consider how many messages you plan to send to business owners and other factors.

What days of the week do you want to contact them? How much time do you leave in between messages? Over what time period are you going to follow up with them before moving on? Do you include cold call, handwritten notes, and LinkedIn messaging to your campaigns?

Qualifying owners

Believe it or not, all of this work will translate into owners who want to hop on a call with you to learn more and see if there’s a potential fit. But how should you prepare and what should you hope to achieve from a call?

At the early stages of an owner relationship, my approach is to understand their story and situation more clearly, then ask a few questions to determine if there’s a mutual fit to continue the conversations. Some may call this screening but I refer to it as qualifying business owners.

When qualifying, I am looking to get ask the most important questions that MUST be in our favor in order for us and our investors to proceed with an acquisition. It can be tempting to drag on conversations with the hopes that an owner might change their mind and decide to sell their business to you, but you should avoid that at all costs. The worst place you can get yourself into is a situation where an owner is neither interested or not, but somewhere in ‘maybe’ land. I try to avoid situations that approach maybe land at all costs.

So what questions do you ask to qualify an owner and gain alignment before moving forward? The following topics can be important to qualify quickly and efficiently:

The owner’s succession plan (if they have one)

Reason for selling

Is there concentrated ownership?

Exit timeline

Size of the business measured by revenue and margins

Is the business growing? If so, by how much?

Any significant revenue concentration? How much does the top 3 customers contribute to total revenue?

These will vary depending on your investment style and criteria, but you can see how some of these questions may be critical in determining whether or not further conversations are warranted. If an owner doesn’t have a succession plan because they don’t want to sell the business for another 10 years, should you keep pushing? How about if the company only has two paying customers and a short operating history?

You will need to determine what these qualifying questions are for your own strategy, but be careful not to drag yourself into a situation where you appear to be leading a business owner on. While you may be hoping to gather insight into an industry through further conversations, always be transparent about what your objectives are and be respectful of their time. You do not want to develop the reputation of a buyer who overpromises and then backs out of commitments, nor do you want to build the habit of being indecisive by failing to efficiently qualify businesses.

For your first month of the search, you may need a training aid to support you during these initial owner calls. It could be a script or list of key points that you follow for these introductory calls, nothing too complex. You want these calls to be casual yet professional, not highly robotic and scripted. I found it helpful to practice my personal story but then leaned on ensuring that I get my top qualifying questions answered. That way I could maintain a good amount of control over the narrative while ensuring I got those important questions answers. It’s up to you, lean on your personal style and attack it. But to be honest, the best training you’ll get is by getting out there, being vulnerable, meeting with owners, and learning from your mistakes.

Although today’s post was one of our longest yet, I hope you found it to be helpful in building your confidence to raise a search fund, getting started with searching, or tweaking processes you have as a current searcher. These topics all warrant their own posts with more detail, and over time I will drill down into each of them to share even more insight. Any feedback you have is greatly appreciated!

If you found the post to be helpful, I ask that you share it to someone who is getting ready to launch their search and encourage them to sign up to for a premium subscription.

Next month, I will share the last of the series with a post on building an engaging internship program and the steps you can take to maximize its effectiveness before launching.