We are back with a quarterly update on my learning in the third quarter of searching. After positive feedback from First quarter lessons and Second quarter lessons, I will continue to share these with you until I acquire a business. For those new to Maverick, these are real lessons I share in my quarterly investor updates but elaborate on them in the post. Each lesson within each one could have a separate post, so I will do my best to remain brief. If you have any questions or would like to dive deeper, please comment below.

Stay positive, trust in the process, and keep refining

In the third quarter, I broke off an LOI that we submitted in a proprietary-turned-brokered deal on a business we had been monitoring for a few months. Despite some exciting tailwinds in the business’s end-market, I could not get comfortable with the lack of proven performance on the company’s new product categories, limited SAM, and customer concentration at the proposed price.

Coming off of the broken deal, it was one of the first times in the search that I began doubting myself. Despite having a repeatable, scalable process to source leads, it seemed that every conversation led to huge valuation gaps or the owner doubting my capabilities. One owner, in particular, found joy in asserting, “You are not an entrepreneur! You haven’t built anything like me!” Spoiler alert: That conversation didn’t last long.

With what felt like setback after setback, the first cracks in my armor began to show. As such, I decided to slow down for a few days and take the time needed to reset. After some brainstorming, a few workouts, and a bit of rest, I regained my footing, and my positivity quickly returned.

Sometimes that is all it takes – a few days of reflection and rest, and in this case, taking two steps back before taking three forward. I recognized I had built out well-established processes but needed to refresh and refine these to reflect where I was in the search journey. As I closed Q3, it was time to take action on where I was falling short to succeed in the new year and next quarter.

Nothing is ever as good or bad as it seems.

Review outreach campaign data more closely to improve internal processes and sourcing efficiency

One area that saw significant improvement was in reviewing my outreach campaign data more systematically. Previously I had built a dashboard with my high-level metrics that gave me a sense of the number of companies we had input into our campaigns, but we had yet to look closely at performance besides the simple statistics shown on my sequencing tool, Reply.io.

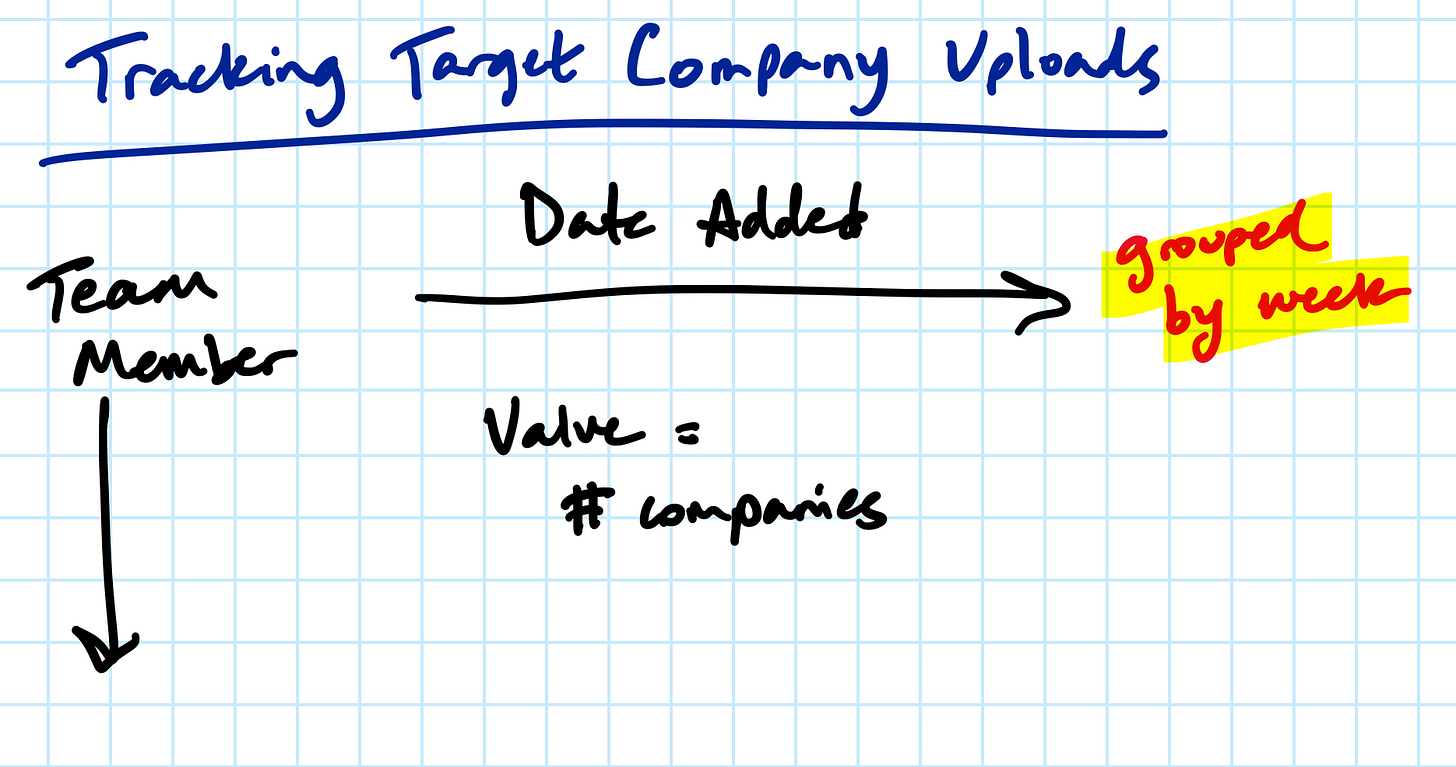

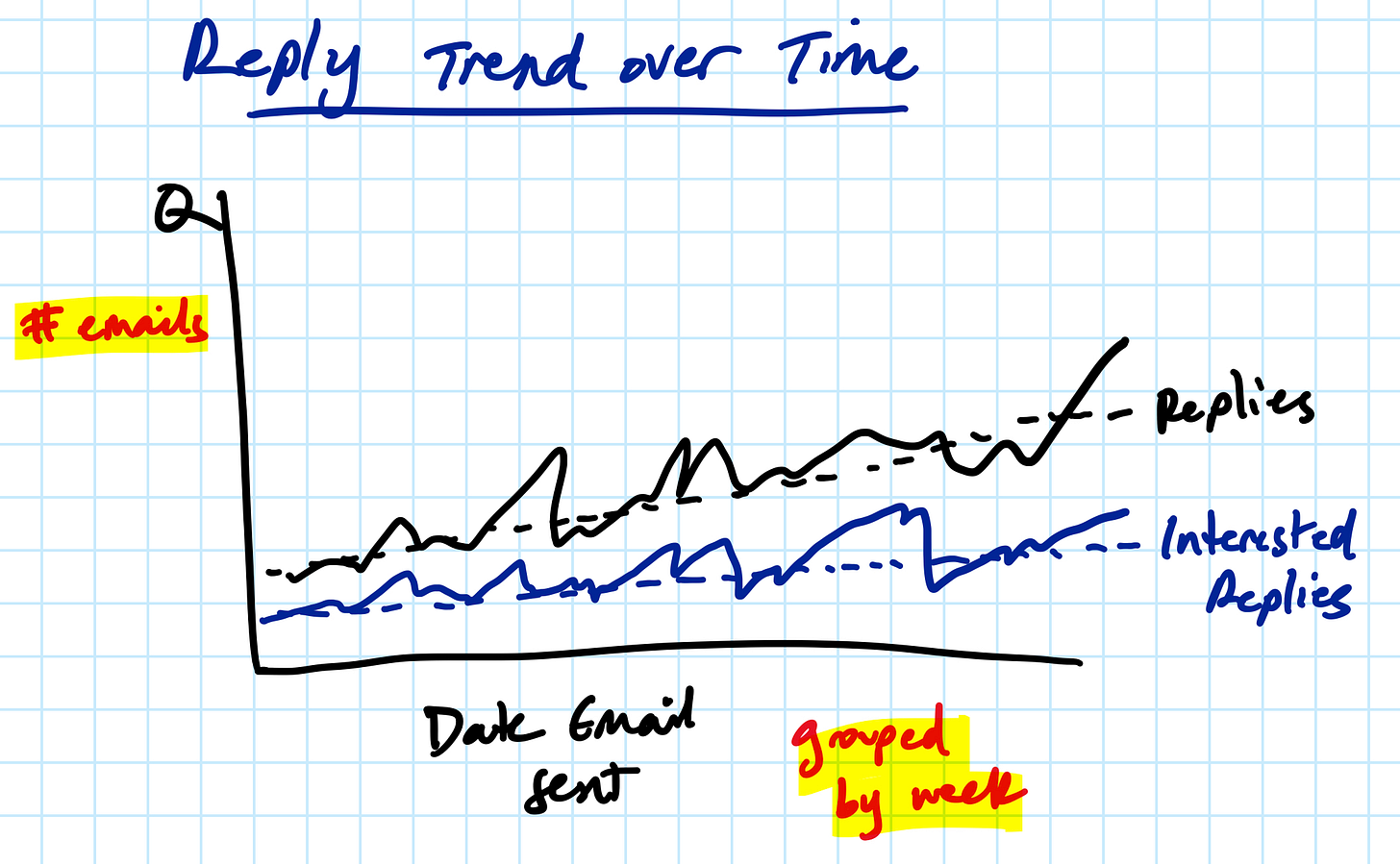

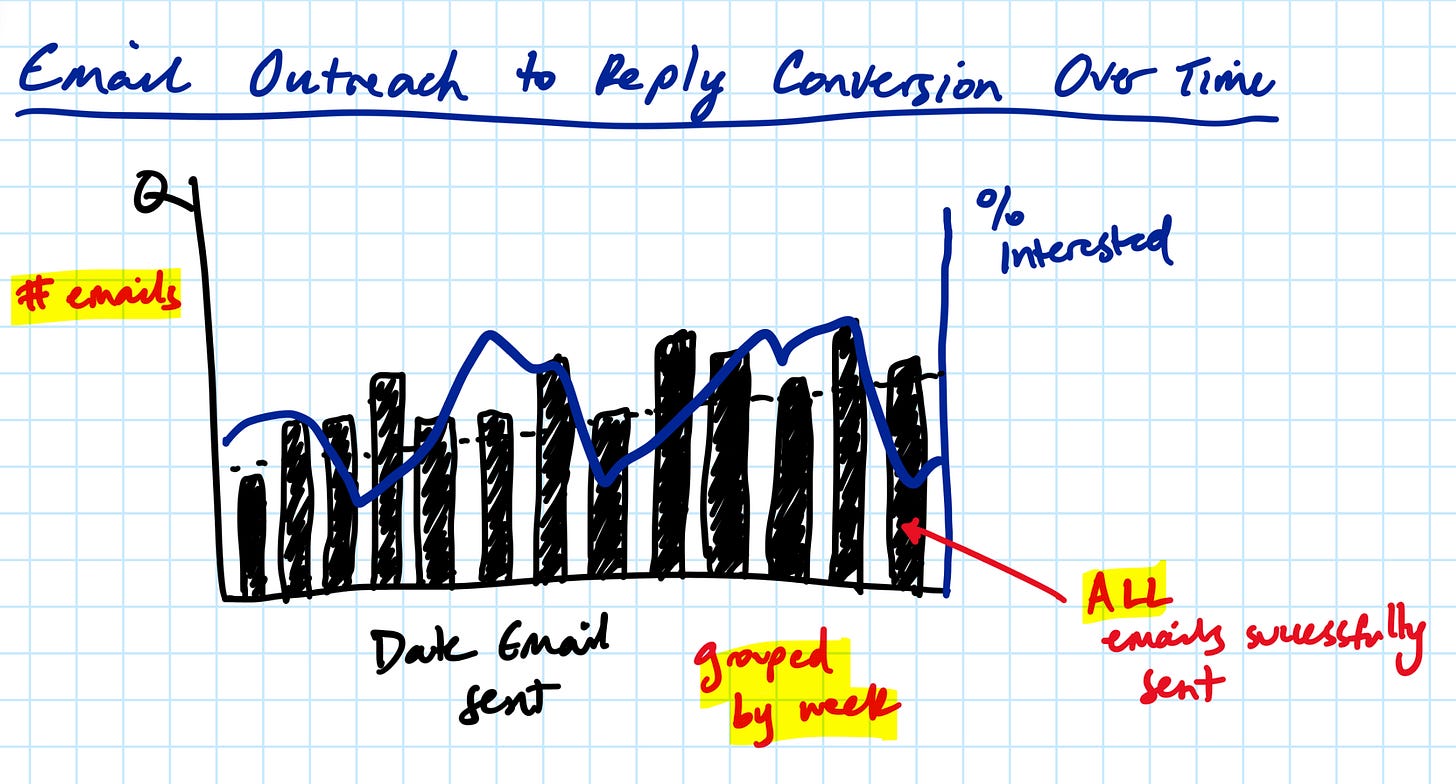

In the third quarter, I built a series of new tables and visualizations to monitor intern sourcing output, weekly email outreach, total replies, and interested ones in a quick way. This work requires a deep-dive post in its own right, but it all began when I joined my email performance data with our fund’s CRM data into one clean, structured table. Now, with a simple data dump from my sequencing tool, I review campaign performance at a much more granular level than before. Here are some of the charts that have helped me:

Equipped with these charts and a few others, I review performance first thing every Monday morning. It also makes for an exciting conversation with interns, and you can hold them accountable when challenging them to meet specific performance targets.

Simplicity is power when communicating an idea

When (or if) you launch your search fund, there is a tendency for searchers to project themselves as the leader of some large investment firm. Or, I frequently see that other searchers beat around the bush with what they’re looking for with generic investment criteria and business model focus (i.e., software, services, etc.). I fell into both camps, actually.

As the search progresses, I have begun to better understand why we all do this. It’s comforting to cast a wide net in hopes of landing a quality business and to feel credible with your friends, family, old colleagues, and business owners with your big, sexy private equity firm.

No one cares. In fact, we are doing ourselves a disservice by not being clear and concise about who we are and what we are looking for. It’s not about being rigid but recognizing that we have little opportunity to connect and get through to sellers. First impressions matter.

So in the third quarter, after reflecting on my broken deal, I invested the time in simplifying my message to business owners through more mindful copy, a new video, and refreshed brand identity.

The changes reflect a more straightforward, concise message that doesn’t shy away from what benefits we can provide to a business owner looking to sell. Now, time will tell to determine its effectiveness, but my early impressions are that certain elements really seem to be working.

Shorten internship programs to maintain higher levels of engagement

Running a well-structured internship program is essential for acquisition entrepreneurs who look to build rich pipelines. It is also challenging to keep undergraduate students engaged for a long time. Because of the investment required in onboarding new team members, it can be time-consuming to continuously worry about training and recruiting new interns to join the team.

As I went into the fall, I wanted to minimize the frequency with which I ramped up and down analysts, so I extended the program from approximately ten weeks to 18 weeks. My pilot turned out to be less effective than expected for several reasons. With the work heavily focused on sourcing, it can be difficult to keep interns engaged despite my best efforts to provide educational materials, research opportunities, mentorship, and interviewing tips for summer internship programs. Towards the end of the program, it took more work to get interns on weekly check-ins with finals and other extracurricular activities.

Moving forward, I’ve returned to a shorter program with improved incentives to increase team engagement. Early efforts are proving successful, as the interns have greater ownership and accountability over their work. Further, with the new training materials I’ve refreshed for the winter quarter, interns are ramping up much quicker and adding significant value to the team.

To quickly recap, the third quarter brought more ups and downs than previously but proved to be one of the more fruitful, insightful periods for improvement. I reflected on what was working well and what wasn’t and then made tweaks to benefit the effectiveness of my search in the coming quarters. While we are still figuring things out, I am confident we are doing the right work.

For previous quarterly lessons: